Stock Market Ticker Tape, 1929

This is a story of fortunes lost, lives ruined, a world plunged into a decade of depression, the end of an era. It’s also a story of infrastructure, which is, almost by definition, pretty dull. So I’ll do my best to make it interesting or at least suitably gory – and there’s even a parade at the end.

Transcript

So, what’s the latest? In our 24/7, up to the microsecond world, you can follow events a world away almost in real time, while keeping up with what your friends are wearing and eating via their Instagram accounts. We take that ability so much for granted that waiting for details or updates, reloading and refreshing, can be frustrating, and it’s difficult to imagine what it would be like not to be completely connected all the time.

This is a story of fortunes lost, lives ruined, a world plunged into a decade of depression, the end of an era. It’s also a story of infrastructure, which is, almost by definition, pretty dull. So I’ll do my best to make it interesting or at least suitably gory – and there’s even a parade at the end.

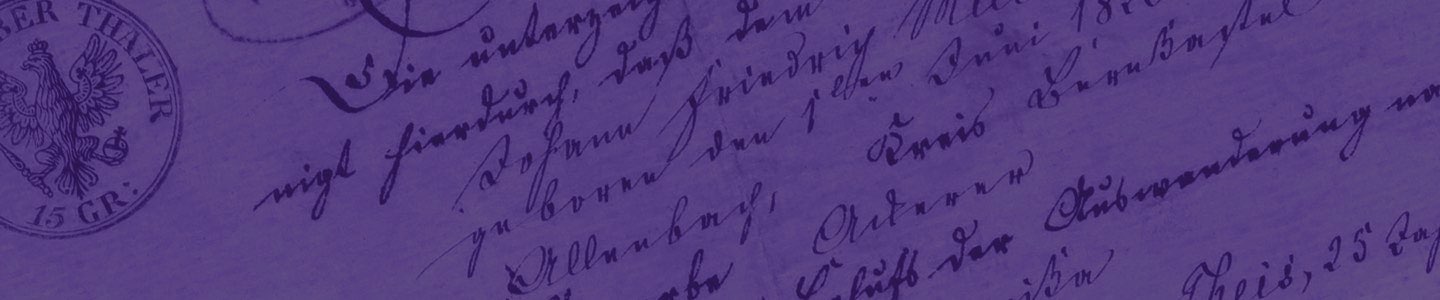

A document that changed the world: Ticker tape, recording transactions on the New York Stock Exchange in late October 1929.

I’m Joe Janes of the University of Washington Information School. Stock market tickers were nothing more than specialty telegraph printers for stock transactions, introduced in 1867, most popularly by E. A. Calahan of the American Telegraph Company; numerous innovations ensued, including one of Thomas Edison’s earliest successes, the Universal Stock Ticker in 1871. They are part of the long tradition of devices and means of getting information about financial matters, from the mail to boats, stagecoaches, horses, carrier pigeons (no kidding), and even the development of a private semaphore signaling system between New York and Philadelphia in the 1830s. Securities trading was among the first telegraph uses in 1844, and by 1887, 87 percent of Western Union’s revenue came from stock traders and racetrack gamblers. All those innovations were meant to squeeze out that little bit of extra time to get the jump on rival investors.

The telegraph, and then the stock ticker, provided a number of advantages: up to date continuous access to information, without having to be physically present on a trading floor, thus lowering costs and cutting out middlemen.

Financial information was now in the hands of the many; more information was flowing to more people in more places more quickly. More subtly, access to that much information had an allure to the point of addiction; a cartoon from 1903 shows a businessman on vacation in a field, in bowler hat and spats, newspaper in hand, secretary and messenger boys at the ready under a lovely tree, right next to his stock ticker. And how long has it been since you checked Facebook?

So how did it actually work? It’s September 3, 1929, and you want to buy 100 shares of US Steel. Call your broker, who calls the floor of the exchange, reaching a trader in that stock, who will find the best possible price; it closed that day at $262/share. You say yes, the purchase is made, and the sale recorded at the exchange, first on a slip of paper, then handed to a keyboard operator who types it in, using the stock symbol, in this case X, number of shares and price. This entry joins a queue from other operators and eventually gets inserted – and this is manual throughout – into an integrated stream sent out by telegraph to many thousands of tickers printing, in codes still used, on a ¾” tape, chattering away all over the world. The ticker was named for its characteristic sound when printing; to this day, any movement of a stock’s price is called a “tick.”

By the late ‘20s, it was widely known that there was a problem. Numerous articles from the period point out the shortcomings of current technology, unable to keep up, at 300 characters a second, with dramatically increasing trading volumes; as one article said in 1928, “Anything less than right now is slow,” discussing efficiencies like better queueing, the availability of a backup system and even using fewer characters to represent stock names all in “a battle to gain…thousandths of a second.” Newer, faster systems were in the works and being deployed but out of fairness they couldn’t be used until universally available, likely in late 1930.

Too late. But, I can hear you asking: surely the ticker tape merely recorded the awful events; where’s the “changing the world” part? Glad you asked. The causes of the market crash have been widely dissected for decades: widespread speculation, based on buying stock on increasingly overextended margins, soft business fundamentals and so on; we won’t rehash that all here. Instead, let’s focus on the days themselves. In 1921, the New York Times index of major company share prices stood at 65, and it rose steadily throughout the decade; by September of 1929, it stood at 449, meaning investments had increased by about a factor of 7. Trading volumes in the ‘20s begin at about 1-2 million shares per day, routinely going over 3 or 4 million and even higher by ’28 and ’29, which causes occasional minor delays as the ticker tries to keep up, though in a rising market, who cares? You’re making money all the time.

On October 21, things start to turn. It’s a big day, volume over 6 million shares, the third largest day ever, and prices fall. The ticker falls behind early and consistently, and it doesn’t finish printing out trades until 4:40 p.m., an hour and 40 minutes after the market closes. Even more worrying, a second service, meant to quote bond prices, was giving real-time updates on major stocks every ten minutes, and that showed values even lower than the delayed stock ticker, merely confirming that things were going south but leaving people without precise information as to how bad.

More bad days followed. On the 23rd, another 6 million share day, another hour and 45 minutes late by the end, and the Times index drops 31 to 384, as the market sheds about $4 billion in value. Then Thursday the 24th, a day characterized as “blind, relentless fear,” and “a wild scramble,” so bad the stock exchange visitors’ gallery is closed. 12.4 million shares trade, and the ticker finishes after 7 p.m., 4 hours late. Newspapers later report on extraordinary scenes of special weekend bus runs and sightseers touring the usually-vacant financial district, and even picking up scraps of ticker tape off the street, as staff works for the first time ever on a Sunday to help clear backlogs – they estimated they would need another week to get caught up.

It was a week they didn’t have. Monday the 28th: 9.2 million shares, ticker 167 ½ minutes late, down 49 points, “mob psychology” rules. Tuesday the 29th, the day usually referred to as the Great Crash: 16.4 million shares, or more – some trades were likely never recorded – 152 minutes late, along with other information problems: rumors, mistakes, fatigue. Words like “vertical,” “perpendicular,” and “sickening” are used. The Times index loses 43 points that day; by November 13 it stands at 224, half of what it was at the peak, and it would bottom out in July of 1932 at 58. Volume dropped dramatically as well, all the way down to 83,000 shares in mid-1940; the trading record of 16.4 million wouldn’t be broken until April 1, 1968, the day after Lyndon Johnson announced he would not run for re-election. Oh, and that Steel stock you bought at 262? It closed at 174 on October 29th, and by July of 1932 it will be a steal – ha – at 22.

It was likely only a matter of time, the bubble had to pop. When it started to fall, and the ticker fell behind, and then when it became clear that things were getting worse fast, it was the not knowing, and moreover not knowing what you didn’t know that helped to feed the panic. So this is an unusual example of a document that is likely simultaneously record, and cause of events.

And, a story of infrastructure. It’s easy to conceive of the ticker device that way, like a faucet or an electrical outlet. Behind the scenes there’s a process, a system, wires, people, tubes, whatever, and that’s all part of it too, and like any infrastructure, nobody pays any attention until it goes wrong.

It’s also, yes, a business story, a technology story, even a psychology story. To me, though, the critical aspect here is the information itself, the numbers and symbols tumbling out on the little strip of tape spelling doom for a way of life for so many. How it’s created, how people get it, what they do with it, and then what happens when it’s wrong, or gone. The entire securities enterprise was built on that information, and moreover its availability, timeliness and accuracy, to support individual and corporate decisions wise and less wise. When that was interrupted, the foundations of those decisions and that enterprise was challenged, which may well have been what pushed over the second domino.

Finally, the parade. If people think at all about ticker tape today, it’s about a parade in what’s called the Canyon of Heroes in lower Manhattan, a tradition going back to 1886. Over 200 such parades have been held, originally with actual ticker tape thrown from windows lining the route; today, copier paper is used. One final legacy of a time, and a document, long since gone.